On August 14, 1935, President Roosevelt signed the Social Security Act into law, which established a system of retirement benefits for employees, industrial accident benefits, unemployment insurance coverage, and aid for dependent mothers and children.

For over 80 years, Social Security has given financial security to Americans. In addition, The SSA strives to prevent and detect fraud against the program. Sadly, there are individuals who try to cheat the system and defraud the American taxpayer.

Social Security-related scam attempts have been on the rise in recent years, with over 568,000 reports received by the Social Security agency in 2021 and losses totaling more than $63.6 million. This scam is being reported by all age groups in high numbers, with older and younger adults filing loss reports at similar rates.

Unfortunately, fraudsters cost American taxpayers billions of dollars annually. In fact, as per the SSA’s Agency Financial Report for Fiscal Year (FY) 2021, about $8.3 billion in improper payments were made in FY 2020.

In this blog post, we'll be discussing social security fraud and how to report it. We'll explore different types of scams and ways to avoid becoming a victim yourself. So whether you're already familiar with social security fraud or just want to learn more, we hope you'll find this post helpful!

What is Considered Social Security Fraud

The Social Security Administration (SSA) has provided a variety of situations that may fall under fraud, including but not limited to:

Making false statements on claims

People applying for Social Security Benefits declare that all information supplied on the applications is true and correct, to the best of their knowledge. It could be a felony if a person reports something they know is false.

Concealing facts or events

If you withhold information that might make someone ineligible, that's considered fraud. One instance would be if you don't report changes in your circumstances that would affect the amount of your benefits, like getting married or starting a job.

Misuse of benefits by a representative payee

If someone receiving Social Security Benefits is not able to manage their own money, SSA appoints a relative, friend, or another individual to handle matters related to the benefits. It's considered a crime if a Representative Payee misuses someone's Social Security Benefits.

Buying/selling counterfeit or legitimate social security cards

Fraud is committed when individuals steal Social Security numbers and use them to obtain benefits illegally. It's also a crime to buy, sell or produce counterfeit Social Security cards.

Misuse of Social Security numbers for the purpose of committing terrorist acts

The misuse of a Social Security Number to facilitate terrorist activity is a federal offense that can lead to a prison sentence.

Criminal behavior by SSA employees

Despite claims to the contrary, SSA employees are not above the law. Employees have been caught stealing benefits and selling counterfeit social security cards. Regardless of what crime is committed, it always inflicts damage on innocent people.

Impersonation of an SSA employee

Criminals posing as SSA employees have previously taken advantage of the elderly, in particular, by requesting money or personal information, including Social Security numbers.

Bribery of an SSA employee

Federal law prohibits anyone from offering, promising to pay, or paying anything of value to a federal employee in return for any official act. This includes influencing the outcome of any Social Security Administration decision.

Misuse of grant or contracting funds

Anyone who misuses Social Security grants or contracting funds will face federal charges. This includes using the money for personal gain or unauthorized purposes.

Violating standards of conduct

The duty of public service is a trust that must be upheld. The Standards of Ethical Conduct for Employees of the Executive Branch are to which all SSA workers are obliged. Any breaches should be reported.

Worker’s compensation fraud

When you receive Social Security disability payments and fail to notify SSA that you're receiving workers' compensation benefits. It's considered fraud if you do not report this income and SSA finds out.

Reporting Social Security Fraud

The Social Security Administration (SSA) asks that you please report any fraud cases to them immediately. If you know or think that someone is committing social security fraud, there are a few ways you can help.

You can contact the Office of the Inspector General fraud hotline at 1-800-269-0271, submit a complaint online at https://oig.ssa.gov/ or send a direct mail to the Social Security Fraud Hotline, P.O. Box 17785, Baltimore, MD 21235-7785.

When calling or filing a complaint online, be prepared to give as much information as possible of the alleged suspect(s) and victim(s):

- Names

- Addresses

- Telephone numbers

- Dates of birth

- Social Security Numbers

Furthermore, it is beneficial to have specifics about the accused fraud, like:

- The day and place of the fraudulent activity

- How the fraud was committed and

- Why they did it

- Who else may have information about the fraudulent activity

SSA OIG has also published a video on how to report social security fraud.

Avoid Being A Victim of Social Security Fraud

Never getting old is one method to avoid being a victim of any common fraud like social security fraud. Joking aside, social security is certainly important as we grow older. Now may be the time to be extra careful about fraud prevention. Here are some easy methods to maintain your social security payments secure.

Guard Your Card

Take Protective Measures Against Social Security Scams

The best way to protect yourself from Social Security fraud is by taking a few preventative measures. Take precautions to safeguard yourself, your friends, and your family!

- When you find yourself in the middle of an argument during a phone call from an unfamiliar or unknown number, Remember to stay cool. When you are pressured, threatened, or scared, do not offer money or personal information to anyone.

- Hang up or ignore it. If you receive a suspicious communication, such as a text or phone call, hang up or do not respond. Government workers will not threaten you, try to obtain your trust by sending you pictures or papers, or demand immediate payment from you.

- Don't fall for Social Security-related scams. If you get a strange call, text, or email regarding Social Security benefits, don't engage with it and immediately report it to the SSA Office of the Inspector General (OIG). There's also no need to feel guilty if you disclosed personal information or lost money as a result of the fraud.

- Keep informed about current events. Keep an eye on SSA OIG's Twitter account, as well as its Facebook page, for the most recent news on Social Security-related frauds. For more information about other federal scams, go to the FTC website.

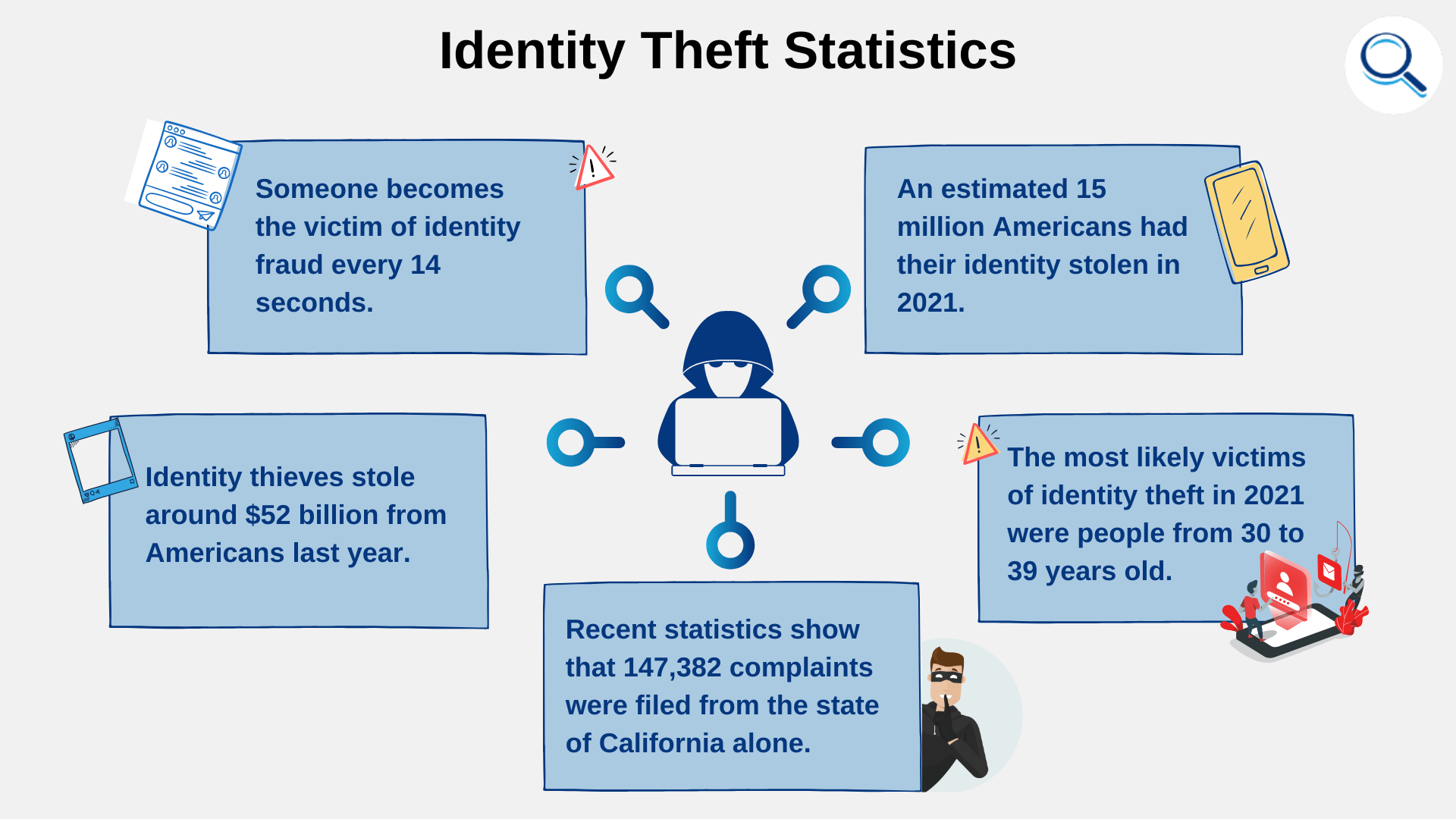

Be Wary of Identity Theft

Identity theft, also known as ID theft, occurs when someone unlawfully uses your personal information for fraudulent purposes. For example, let's say somebody wants to open a new credit card account in your name while using their own Social Security Number (SSN), or maybe they apply for a bank loan using false information while pretending to be you.

Illegally assuming your identity can cause all sorts of problems and headaches down the road, but there are things you can do to help prevent this from happening:

- Keep your Social Security card in a safe place. Don't carry it with you unless you're using it for a specific purpose.

- Don't give out your SSN to just anyone. Ask why they need the information and how they plan to use it before you provide it.

- Be wary of fraudulent attempts (emails, internet links, and phone calls) to get you to provide confidential information.

- Protect your computer by using security software and keeping it up to date.

- Create a personal My Social Security account to assist you in keeping track of your paperwork and detecting any fraudulent behavior.

- Consider adding the blocks The eServices block and The Direct Deposit Fraud Prevention block to your account. By adding these blocks, your personal information will be hidden on the internet from anyone - including yourself. If you want to remove the block, a representative will have to contact your local office.

The Bottom Line

It's always important to be aware of social security fraud and how to protect yourself from it. But don't worry, by following our tips and being vigilant, you'll be able to keep yourself and your loved ones safe!

And if you do happen to fall victim to a scam, don't feel bad! Just report it immediately to SSA. You can also take measures to avoid being a victim of social security fraud, such as safeguarding your social security card and being aware of identity theft. Protect yourself and help keep social security benefits safe for everyone. Stay informed and stay safe!

FAQ

Who investigates Social Security fraud?

The Office of the Inspector General (OIG) is responsible for investigating fraud, waste, and abuse allegations within the Social Security Administration (SSA).

What is the punishment for Social Security fraud?

Felony criminal penalties for Social Security card fraud and disability fraud can be up to $250,000 in fines and/or five years of jail time. In addition to criminal penalties, there may also be civil penalties.

Does the Social Security office call you about suspicious activity?

No, the Social Security office will not call you about suspicious activity. The Social Security Administration will only communicate with account holders through the mail to ensure safety against scammers. If you receive a call from anyone claiming to represent the SSA and asking for personal information, it is most likely a scam. To report this incident, hang up and immediately call the Social Security Administration directly.

What can someone do with the last 4 digits of your SSN?

Fraudsters can use the last four digits of your social security number and date of birth to steal your identity in a variety of ways. This information allows them to open credit card accounts, steal benefits, and commit other crimes using your name.

Can you freeze your Social Security number?

Yes, A security freeze is placed on your credit report by request and can only be removed by you. Security freezes are designed to protect your credit reports from being accessed to open new credit accounts, with a few exceptions.